Financial Wellness Reimagined

Simplified, integrated way to empower customers and employees to plan, simulate, and make smarter decisions via super app.

Financial Wellness Reimagined

Simplified, integrated way to empower customers and employees to plan, simulate, and make smarter decisions via super app.

What We Do

A B2B platform with a new approach to help 100 million people build stronger financial lives. Machine learning-powered, new gamified tools, and human-centered design brings decision support to all major life events and at every life stage.

What We Do

A B2B platform with a new approach to help 100 million people build stronger financial lives. Machine learning-powered, new gamified tools, and human-centered design brings decision support to all major life events and at every life stage.

Why It Matters

Product Features

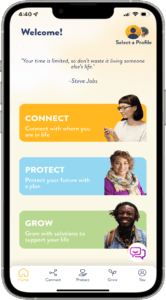

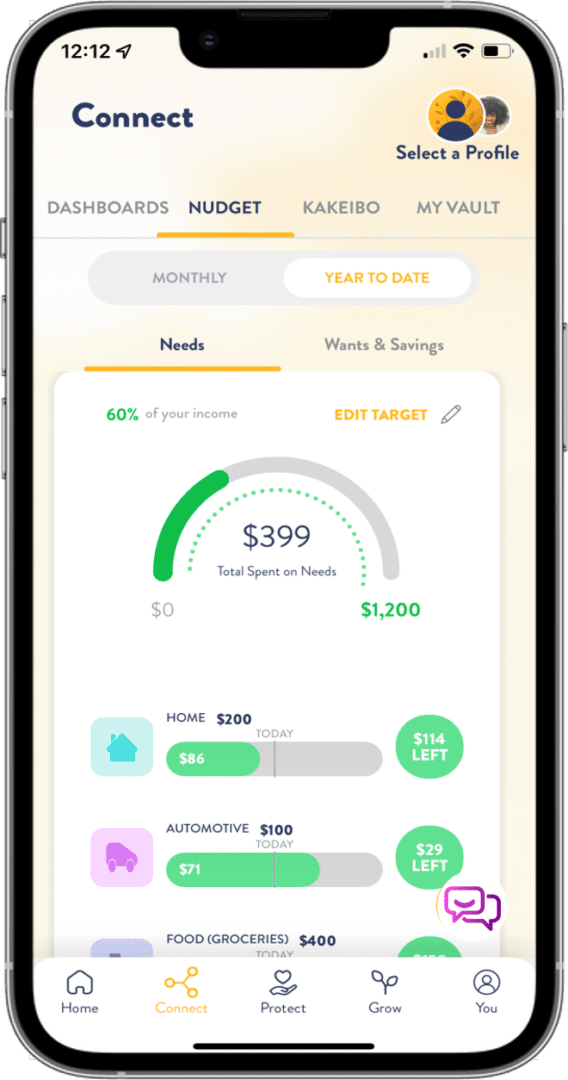

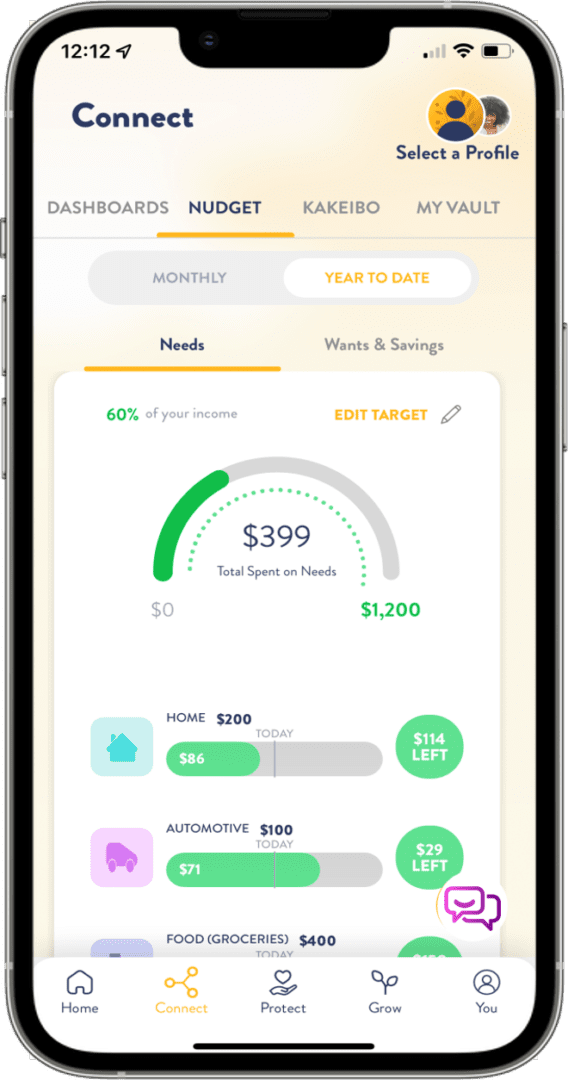

CONNECT

with where you are in life

Get organized and understand where you are. Link your accounts in one place. Simple snapshots of your financial life.

- Dashboards

- Nudget/Budget

- Vault

- Notebook

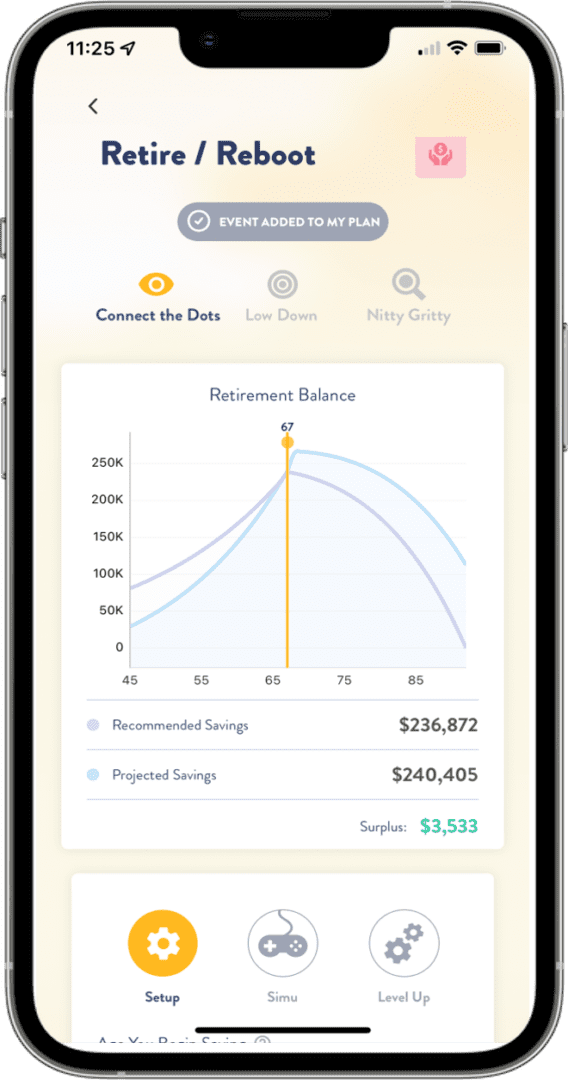

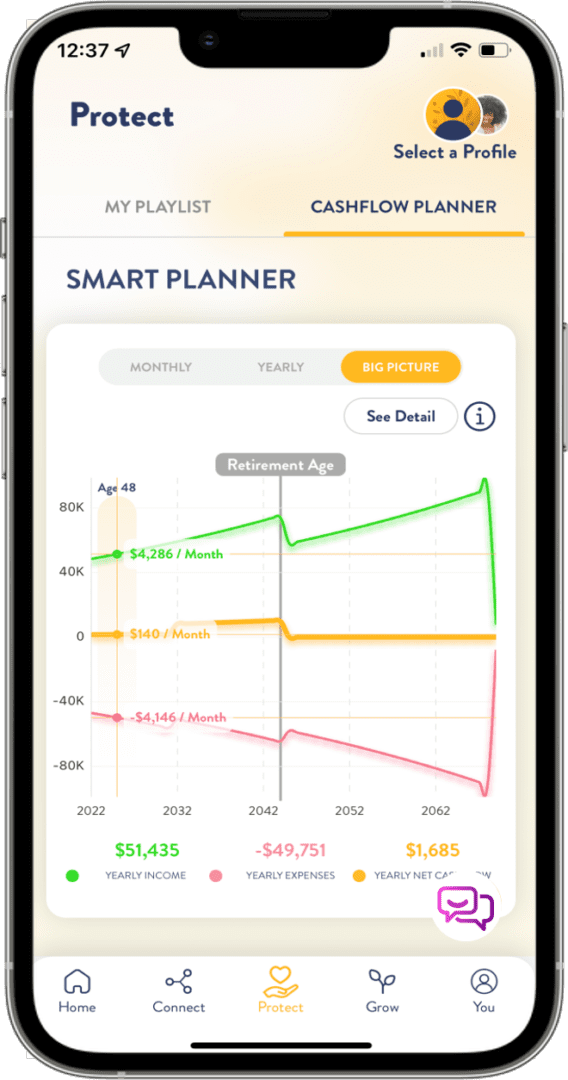

PROTECT

your future with a plan

Prioritize and make better decisions with intuitive, interactive and game-like planning tools. AI-based insights and hacks. Life planning made simple from college to retirement tools for every life stage.

- Hacks/Life Events

- Playlist/Simulation

- Planner/Cashflow

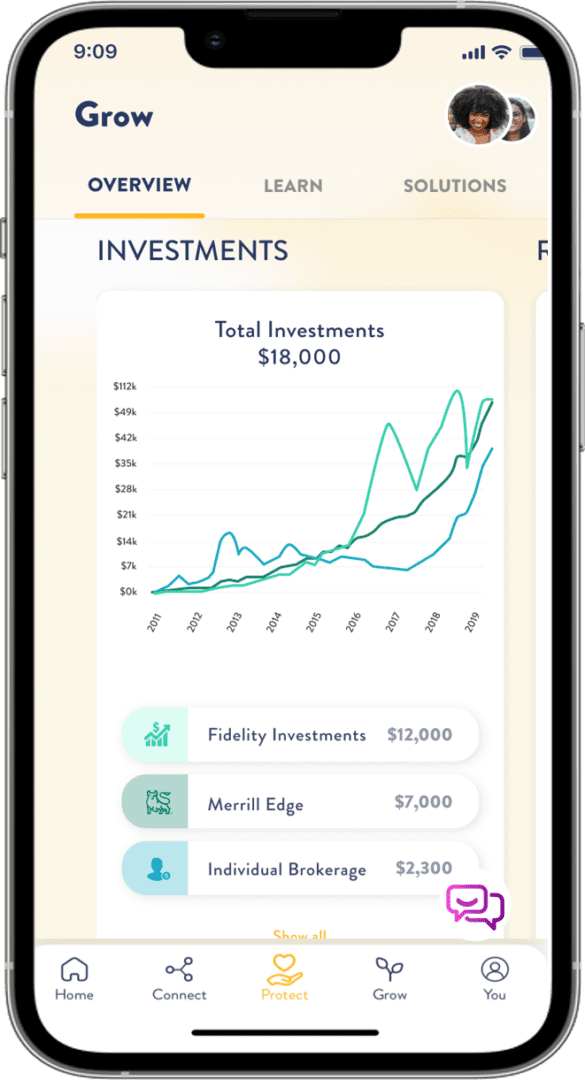

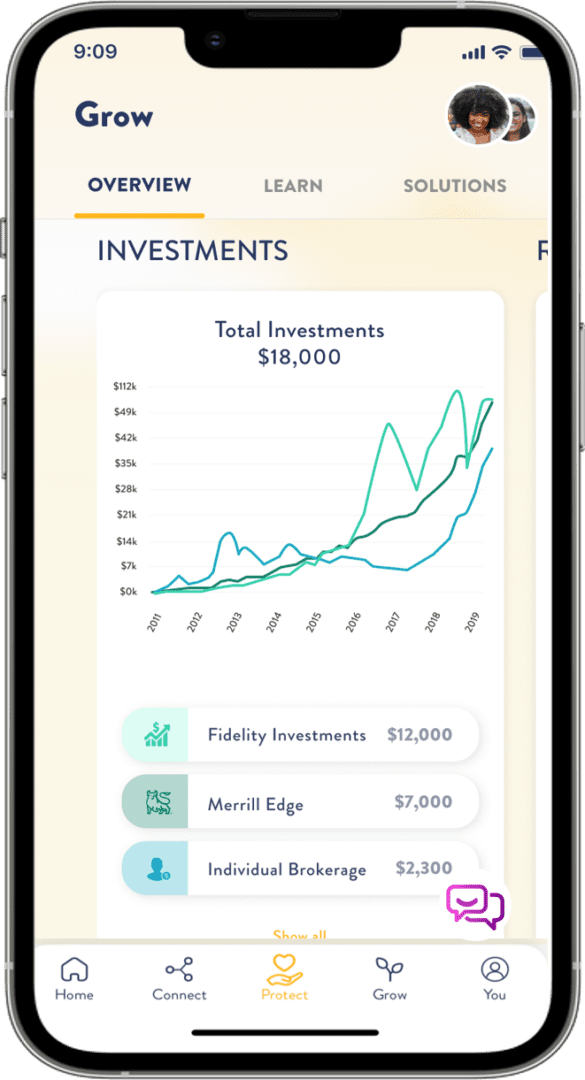

GROW

with solutions to support your life

Understanding the basics of investing, risk, asset allocation and the impact of fees. Build loyalty through tailored interactions and relevant solutions.

- Portfolio

- Market Insights

- Risk Simulations

- Insurance Quotes

- Retirement

- Solutions Portal

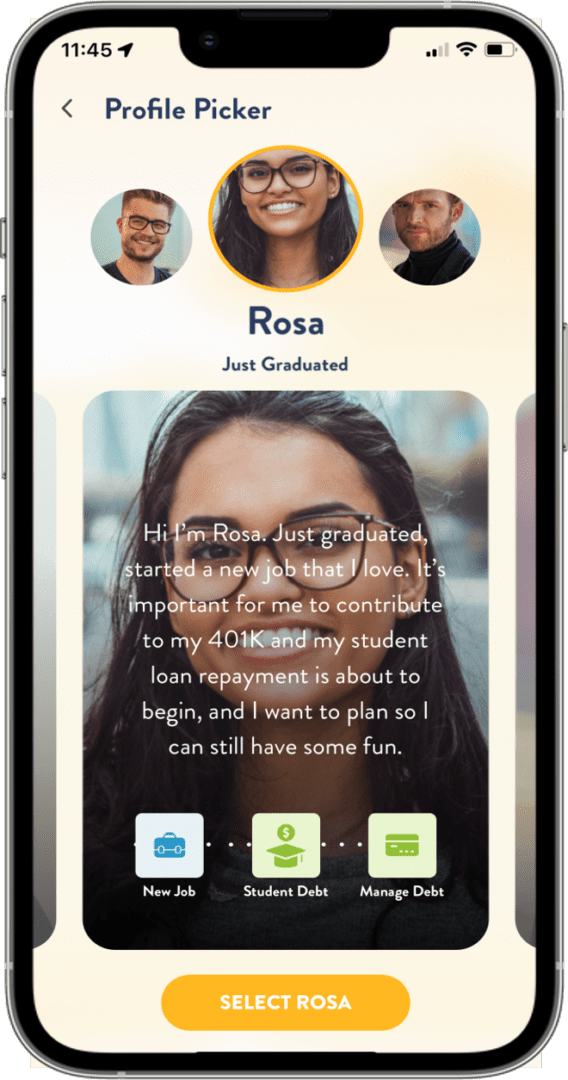

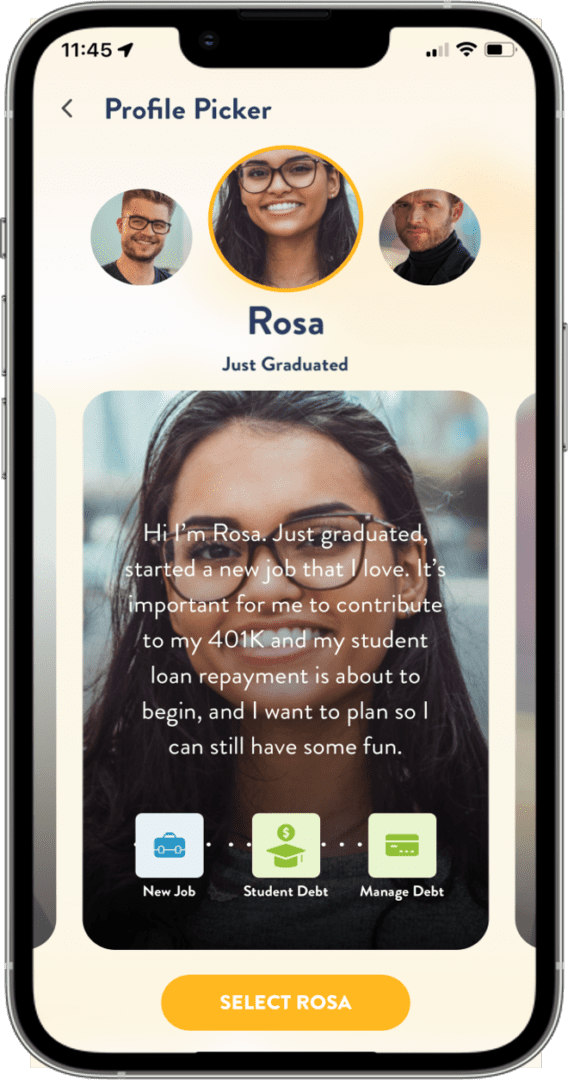

Learn From

Someone Like Me

Choose a Profile and Learn from Someone Like Me

- Planning made simple:

Retirement, buy a house or a car, budget, savings, debt, investments. - Admin portal to customize profiles to match any segmentation for employees or customers.

CONNECT

with where you are in life

Get organized and understand where you are. Link your accounts in one place. Simple snapshots of your financial life.

- Dashboards

- Nudget/Budget

- Vault

- Notebook

Learn From

Someone Like Me

Choose a Profile and Learn from Someone Like Me

- Planning made simple:

Retirement, buy a house or a car, budget, savings, debt, investments. - Admin portal to customize profiles to match any segmentation for employees or customers.

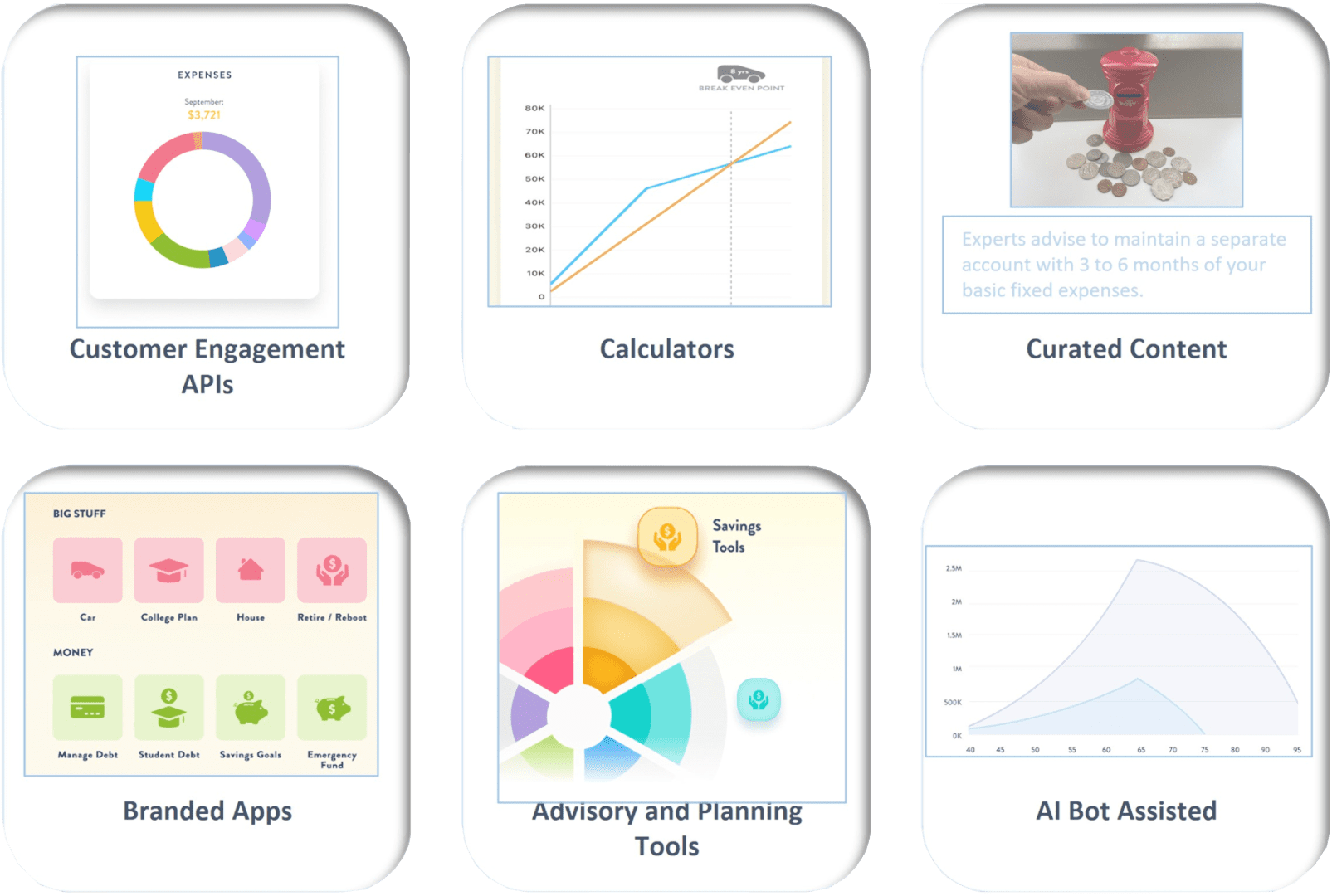

ENTERPRISE BENEFITS

Scalable SaaS/PaaS per-member pricing

- Customizable white/gray label

- Flexible API access for enterprise applications and members

- Seamless customer engagement integration layer

- Backend for Frontend (BFF)

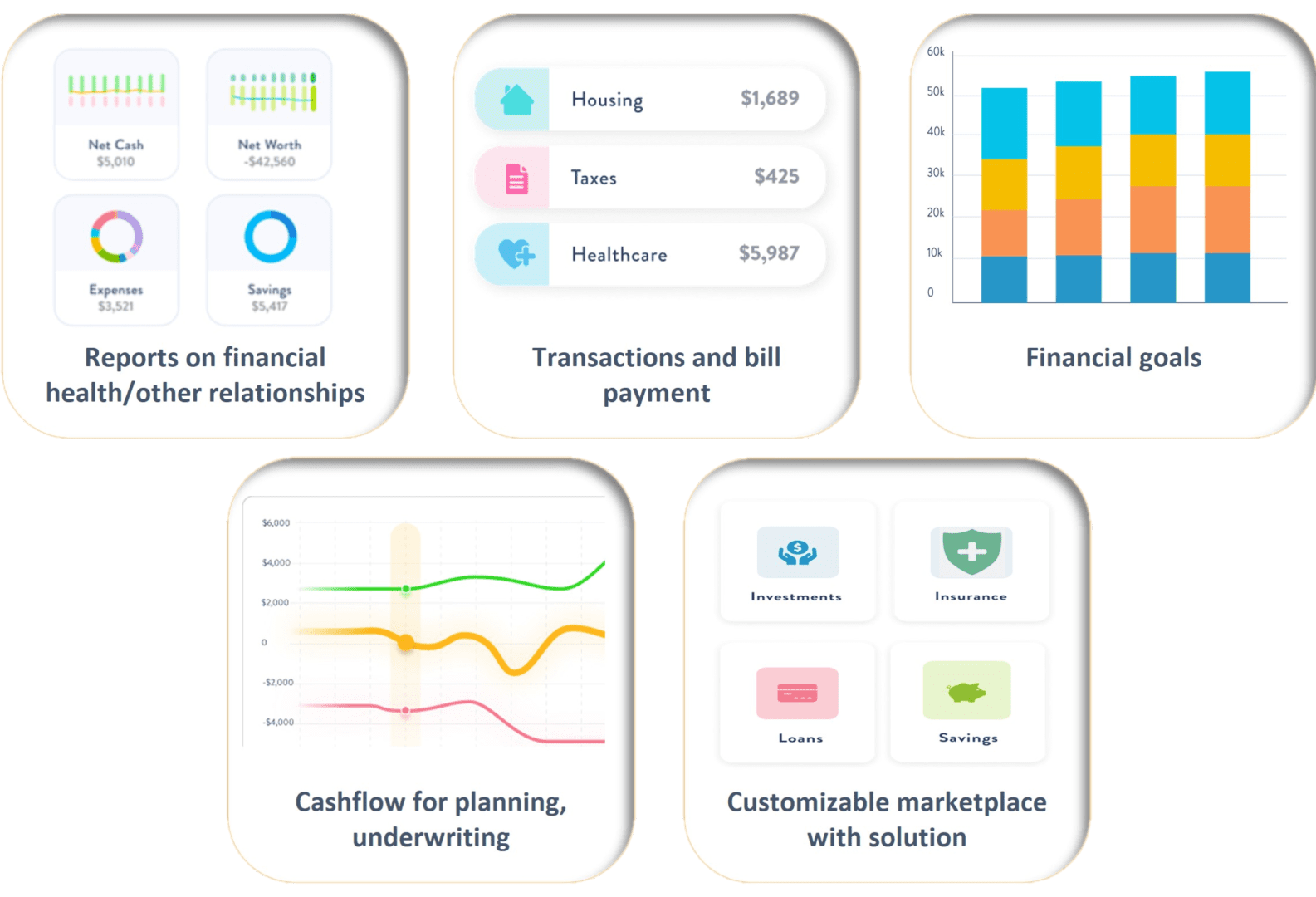

PARTNERSHIP BENEFITS

Data to Drive Engagement,

Loyalty, and Commerce

- Customizable reports and rich meta data

- Reports on financial health/other relationships

- Transactions and bill payment

- Financial goals

- Cashflow for underwriting

- Dynamic marketplace

ABOUT US

MISSION-LED, FEMALE-FOUNDED

EqualFuture is a San Francisco-based FinTech company founded by Joyce Phillips with a mission to help everyone have a shot at an “equal future” by making better financial decisions.

Joyce brings significant global financial expertise to EqualFuture, previously holding executive leadership roles with some of the world’s most iconic corporate brands, including GE, Citigroup, AIG, Australia and New Zealand (ANZ) Banking Group. An award-winning leader, innovator, and marketer, Joyce is passionate about FinTech and pioneered the early use of artificial intelligence and machine-learning technology in financial services. She is fiercely dedicated to providing consumers with greater access to well designed, inclusive financial solutions.

Through EqualFuture, she is focused on helping more individuals achieve financial wellness and live more satisfying, richer lives.